It’s been a while. Happy belated New Year. I was thinking whether to start blogging again or not, haha but anyway since I have the free time now, I decided to post.

Last year my port ended at about +49.33%, starting from a total of 600k (400k which I received in the 4th month, April, meaning I had 66% of my capital for 8 months only). Anyway to make the computations simpler I just decided to calculate the performance of my capital for the year. 600k ended at 666k total equity value + 230k worth of withdrawals (80k from me and 150k from an investor).

This year stocks are starting to soar, more and more people are getting interested in investing in our market, valuations wise, it seems a bit high, but with money flooding around how can you define what’s high and what’s not? It’s hard to fight with government intervention. I think one can still play this market selectively. After flying like a big birdie, our market, I think is bound to rest for a while (which is actually a good time to add position?), but if there’s no big drama the run will probably be sparked up again by the upcoming earnings season.

I started After Christmas day, since I thought that it was a good time to buy for the coming year. Funny thing is that I started at a very cute number, 666k. So far so good total port value is now at 712k, amassing 6.9% (another cute number) for the YTD. Last year I almost reached 70 to 80% but due to my lack of focus it went succumbing back to 49%. Oh well. Profit is profit, I can’t put that much pressure on myself knowing that it was just my first year from the market. At least, I learned some essential lessons.

———————————————————————————————————————————————————————————————————————————-

Here are some of them:

1. Listen to tips, but don’t let your guard down – Admittedly there was this one big instance that took a big chunk in my port, perhaps that was the biggest lost I had to take for the whole year. I got this tip on a stock and it was perfect, charts good, story good, moving as expected, then it moved but the rumor was far from the current price. Even though I had good profits I did not follow the charts, sell signals, support levels broken, and my cut loss points. That was a very wacky trade and I promise never to do it again. It’s good to listen to the opinion of others, but never let them control the way you trade, if something sounds good, assess the circumstances first and make sure you follow your system/plan in line with the speculative trade. A big factor that got my guard down during that trade was the TRUST I had for that particular source.

—

2. You trade the best when you are relaxed. It’s all about Patience Patience Patience and CONTROL – Watching all my posts before, if I did not go in and out every time there was a minor break down in the chart, or if I felt that there was a coming sell down, I could’ve profited greatly just by holding certain stocks like AC, CMT, PIP, and EEI. When you enter a stock, think about it as a flower, it won’t bloom instantly. Again and again this is the most important lesson for me–“The big moves give you the big money, and most of them don’t happen overnight” & “It’s the sitting that made me money not the thinking“–excerpts from reminiscence of a stock market operator . There are times where range trading and day trading is good, but if you fail to execute perfectly, you would’ve profited more if you just positioned well in well timed buy points. Set parameters so that you have more allowance in your exit plans in case the trades don’t follow through, don’t just get out because the market feels like shit, sometimes that shitty feeling is actually the perfect time to buy. When you see your port in red but with tolerable losses, just relax, chances are the trade just needs time to manifest.

—

3. Balance your allocations – as much as it is fun to go ALL IN in conviction plays, chances are one mistake will eat you up alive. If you really feel something for a trade, or if you’ve done your homework well then go, do it! Go ALL IN! but in regular times, keep proper balance as not to get overly emotional on your trades. 🙂

—

4. Rest when weary – After a huge run, you might encounter losing streaks that can get in your head, well that’s what happened in my case. At the same time I had a hard time to trade while doing daily responsibilities, I realized that I would’ve fared better using a live broker, during the last 3 months. Anyway, point is, if you cannot focus and dedicate yourself, and if there’s too much pressure in your trades, rest for a while, remember, you perform the best when you are in a peaceful state.

———————————————————————————————————————————————————————————————————————————-

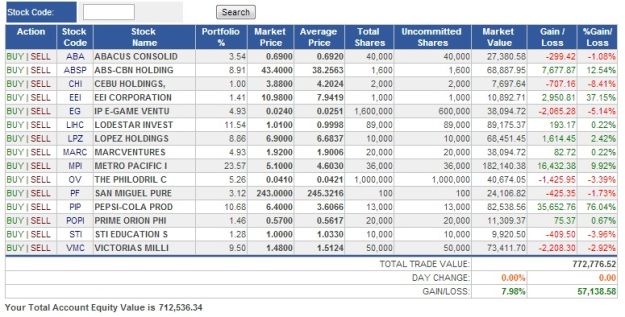

Here’s my port:

—

No sense in hiding, I’m just a small time player anyway. 🙂

Most of the positions there are new ones. Just waiting for the proper time, there are lots of test buys there too. I’m still trying to work my way around this smaller port, since I got used to working at 800k to 900k’ish.

Feel free to comment suggestions, feedbacks, rants, love quotes and what not. Farewell. -Imba